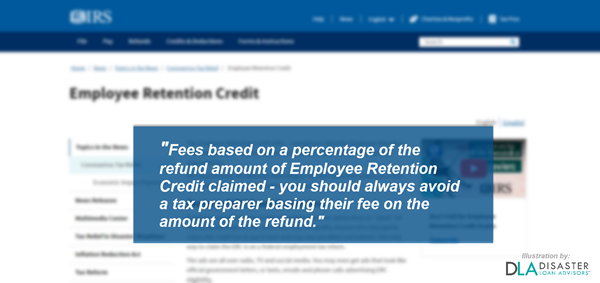

The employee retention credit was designed to put business tax refunds in the hands of companies that legitimately qualify for the tax credit. Unfortunately, there are many payroll companies, CPAs, accountants, tax preparers, consultants and ERTC firms out there charging a contingency fee based on a percentage of the companys’ ERC tax refund. The problem with this? The Internal Revenue Service clearly states it is prohibited to charge in this manner. Yet, many business owners have been paying a percentage of their hard-earned tax credit refund after being led to believe this is the “normal” way to pay for ERC services. Not so, says the IRS.

Business owners should never pay a percentage % or contingency fee based on the amount of their ERC tax refund, says the IRS. Image Credit: Kuprevich / 123rf.

“As business owners grapple with the complexities of the Employee Retention Credit (ERC), they need to wake up and fully understand that the IRS prohibits charging a percentage or contingency fee based on the amount of a tax refund. Yet many ERC companies are charging businesses in this exact way. Not us though. We carefully follow all IRS guidelines when it comes to the employee retention tax credit,” said Marty Stewart, Chief Strategy Officer (CSO) with Disaster Loan Advisors (DLA).

“The IRS says contingency or percentage-based fees are prohibited when preparing either an original or amended tax return. Since the ERC credit is claimed by filing an amended 941-X for each quarter that qualifies, this means that anyone or any company you engage with, may not charge in this manner. The IRS clearly states this. Any person or company touching and amending IRS tax form 941-X for your business, falls under these guidelines according to the IRS,” continued Stewart.

Employee Retention Credit Key Takeaways Businesses Should Follow to Protect Themselves

- Employee Retention Credit (ERC) fees vary depending on the amount of work and services provided, but companies generally charge an average cost for assisting with ERC claims.

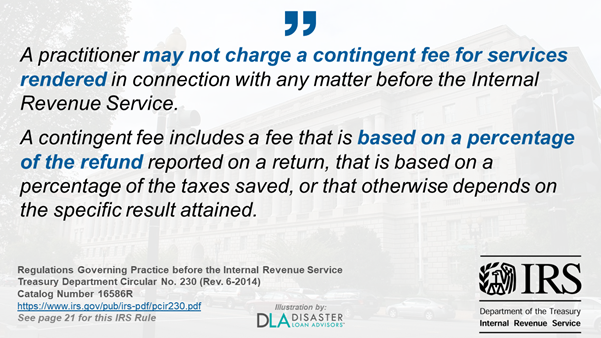

- Besides the IRS rules, Certified Public Accountants (CPAs) cannot charge contingent fees for preparing original or amended tax returns related to ERC. Instead, they should bill their ERTC assistance services using traditional billing arrangements such as hourly or fixed fees.

- Contingent fees are not permitted for CPAs, accountants, bookkeepers, tax preparers, payroll companies, consultants, attorneys, law firms, or any other person or company providing ERC services. This is according to IRS guidelines set out by Circular 230 and separately by the American Institute of Certified Public Accountants (AICPA).

- The IRS says it is important to be cautious of unscrupulous practices in the market and avoid falling for aggressive marketing tactics that promise inflated ERC amounts or guarantee audit protection. Compliance and accuracy should always be a top priority when claiming the ERC tax credit.

IRS warning to business owners directly from the official IRS.gov/erc website. Image Credit: IRS.gov. Illustration by: Disaster Loan Advisors.

Overview of the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a refundable tax credit offered by the federal government to help businesses bear the costs of retaining employees during the COVID-19 pandemic. This credit equals 50% of qualified wages paid (in 2020) to an employee between March 12, 2020, and equals 70% of qualified wages paid (in 2021) through December 31, 2021.

This includes qualified health plan expenses that are allocated to such a period. Eligible employers must meet certain criteria to qualify for the IRS ERC credit. As per IRS guidelines, employers must have experienced suspended operations due to governmental orders or significant revenue decline compared with 2019 or equivalent periods before claiming eligibility.

Importantly, there are several restrictions on claiming these tax refunds, including not being able to receive other credits or deductions for the same wages used when taking advantage of the ERTC benefits. For example, Paycheck Protection Program PPP loans must be deducted from the same wages that might qualify for the ERC credit.

Eligibility Criteria for Claiming the ERC Tax Credit

To be eligible for the Employee Retention Tax Credit (ERC), employers must have experienced a full or partial suspension of operations due to orders from an appropriate governmental authority, such as stay-at-home orders issued in response to the COVID-19 pandemic.

Eligible business taxpayers can claim the ERC on their amended employment tax returns during a qualifying period, which is by filing IRS form 941-X for each quarter that qualifies. It is important for businesses looking into claiming the ERC credit to remain aware and diligent when engaging with third parties who may try to promote claims that do not qualify under IRS guidelines.

Employers should remember that any ERC claim will reduce their allowable wage deduction on their income taxes, making it very important that all eligibility criteria are met. Correct ERC claim applications are submitted to optimize qualified refund payouts from the program.

How the ERC Credit Benefits Employers

This tax credit can provide significant relief for businesses affected by the economic uncertainty brought on by the pandemic and presents an opportunity for employers who meet specific criteria outlined in IRS documents to obtain financial benefits they would otherwise not receive.

With no limit on how much may be claimed cumulatively through December 2021, business owners can take advantage of this tax incentive and see returns that could reduce their payroll expenses or even result in refunds from prior quarters from 2020 and 2021 that legitimately qualify.

These tax credits can be applied retroactively. Business owners have until April 15th, 2024 to file amended 941-Xs to claim the ERTC credit for the 2020 tax year. April 15th, 2025 is the deadline to file for the past 2021 ERC tax year.

IRS Warning: Beware of Improper ERC Tax Credit Claims

The IRS is cautioning employers to be aware of scams and schemes related to the Employee Retention Credit and aggressive marketing tactics from third parties.

These important IRS guidelines that protect business taxpayers and their tax refunds can be found in Treasury Department Circular No. 230. Image Credit: IRS.gov. Illustration by: Disaster Loan Advisors.

Risks and Consequences of Making False or Improper ERC Claims

Making false or improper claims for the employee retention credit can have serious consequences, including repayment of the credit with interest and penalties and even being subject to an audit or criminal investigation by the IRS.

Taking inaccurate positions on tax return filings relating to ERC eligibility carries substantial risks and non-compliance with Internal Revenue Service guidelines, which could result in costly audits and significant fines.

Taxpayers should thoroughly familiarize themselves with IRS guidance and speak in detail to an ERC tax expert before claiming this important refundable tax credit, as it is lucrative but complex. For instance, eligible employers must meet certain criteria specific to their industry, such as limits on gross receipts decline from prior year amounts due to COVID-19 related business disruptions.

Unscrupulous third parties may entice taxpayers into taking incorrect positions on their returns when claiming the ERC due to the temptation offered by sign-up bonuses that far exceed reasonable or customary rates. This can lead unsuspecting employers down a path of potential adverse governmental action resulting in hefty fees, fines, liens against personal assets as well other highly unfavorable outcomes. The IRS is cracking down on ERC tax fraud.

Scams and Schemes Related to the ERC

With the introduction of this tax credit to help employers retain their employees during difficult times, it is inevitable that some third parties will seek to take advantage of businesses eligible for the employee retention credit, including charging them a 10% to 30% contingency fee.

The IRS has issued multiple warnings regarding scams and schemes related to false or improper claims for this credit. These tactics typically involve aggressively marketing services such as assistance claiming the ERC, with unscrupulous promoters charging high percentage-based contingency fees.

Businesses should be aware of these potential risks before engaging any third-party entities and can protect themselves by closely examining any offers related to the ERC claiming process. In addition, business owners should not trust companies that are charging based on a percentage or contingency fee. The IRS says this is prohibited, no matter what a third-party company may tell you.

Examples of Aggressive Marketing Tactics by Third Parties

Third-party firms have employed aggressive marketing tactics in promoting improper ERC claims. Examples of these tactics include relentless unsolicited phone calls and emails, unlicensed or unqualified representatives offering advice on complex tax matters that they are not qualified to provide, pressuring businesses to accept their services without a thorough assessment of their credentials, and making false statements regarding the qualifications or capabilities of the firm’s staff.

Navigating the IRS Guidelines for ERC Services

All companies and financial professionals must comply with specific employee retention credit IRS guidance and regulations when preparing ERC claims to avoid penalties and to protect their clients.

Cornerstone of the Internal Revenue Service headquarters building in Washington DC. Image Credit: Tashka / 123rf.

About Disaster Loan Advisors™ Employee Retention Credit (ERC) Services

Disaster Loan Advisors™ (DLA) is a trusted team of financial tax professionals and Employee Retention Credit (ERC) consulting specialists dedicated to saving businesses from lost sales, lost customers and clients, lost revenue due to financial and economic harm caused by the COVID-19 / Coronavirus disaster, Delta and Omicron variants, and other recession and inflation downturns in the economy.

Having worked with over 1500+ business clients navigate the SBA Economic Injury Disaster Loan (EIDL), Paycheck Protection Program (PPP), and Restaurant Revitalization Fund (RRF) programs, DLA further refined its expertise in the ERC Tax Credit IRS program having assisted more than 700+ companies with their ERC Claims. Assisting ownership groups with multiple business entities, multiple location business owners, and other complex situations that require an expert tax and accounting strategist to be brought in to assess the situation and create the most strategic path forward.

DLA further specializes in another key pandemic-era SBA / IRS program where business owners are leaving a lot of relief fund money on the table. It is the often misunderstood and confusing Employee Retention Tax Credit (ERC) / Employee Retention Tax Credit (ERTC) program whereby company owners and partners can retroactively receive up to $26,000 to $33,000 back for each W-2 employee they had on payroll for the 2020 and 2021 tax filing years. Done correctly, these tax credits or cash refunds can be claimed retroactively for up to 3 years.

It’s encouraged that business owners obtain professional assistance in going through the complex 941-X amended filing process to help your company maximize the full value of the ERC Credit Program, while staying safe and compliant within the complex IRS rules and regulations for claiming the ERC Credits.

DLA doesn’t charge a percentage (%) of your ERC refund like many companies are charging. Instead, DLA works on a reasonable professional flat-fee basis. If you are looking for an ERC company that believes in providing professional ERC services and value for small business owners, in exchange for a fair, reasonable, and ethical fee for the amount of work required, Disaster Loan Advisors is a good fit for you.

Need Strategic Employee Retention Tax Credit Guidance?

CONTACT:

Disaster Loan Advisors

Elena Goldstein

Director of Media Relations

877-463-9777 ext. 3

[email protected]

Connect with Disaster Loan Advisors via Social Media:

Linkedin, Facebook, Instagram, Twitter, Youtube, and CrunchBase.

For an Employee Retention Tax Credit Deep-Dive Evaluation Analysis for Your Business, Visit:

https://www.disasterloanadvisors.com/erc

SOURCE: Disaster Loan Advisors™ (DLA)

Learn more here https://www.accesswire.com/766798/Employee-Retention-Credit-Contingent-Fees-Unlawful-Says-IRS